[ad_1]

Erdark/E+ via Getty Images

A Quick Take On Jianzhi Education Technology Group

Jianzhi Education Technology Group Co Ltd – ADR (JZ) has filed to raise $30 million in an IPO of its American Depositary Shares representing underlying ordinary shares, according to an F-1/A registration statement.

The firm provides professional training and education via its digital education content platform.

Given ongoing regulatory uncertainties and the high price of the IPO, I’m on Hold for JZ, although the stock may see high volatility from day-trader interest.

Jianzhi Education Overview

Beijing, China-based Jianzhi Education was founded to offer educational content and IT services to education institutions in China and has since expanded to focus on providing professional education content to consumers directly, focused on the Shanghai and Guangzhou provinces in Southeastern China.

Management is headed by Chief Executive Officer Yong Hu, who has been with the firm since February 2017 and was previously general manager of the Rongji Wuyi (Beijing) Information Technology Co.

The firm was founded by Chairwoman Peixuan Wang, who was previously president and chairwoman at Beijing Sentu.

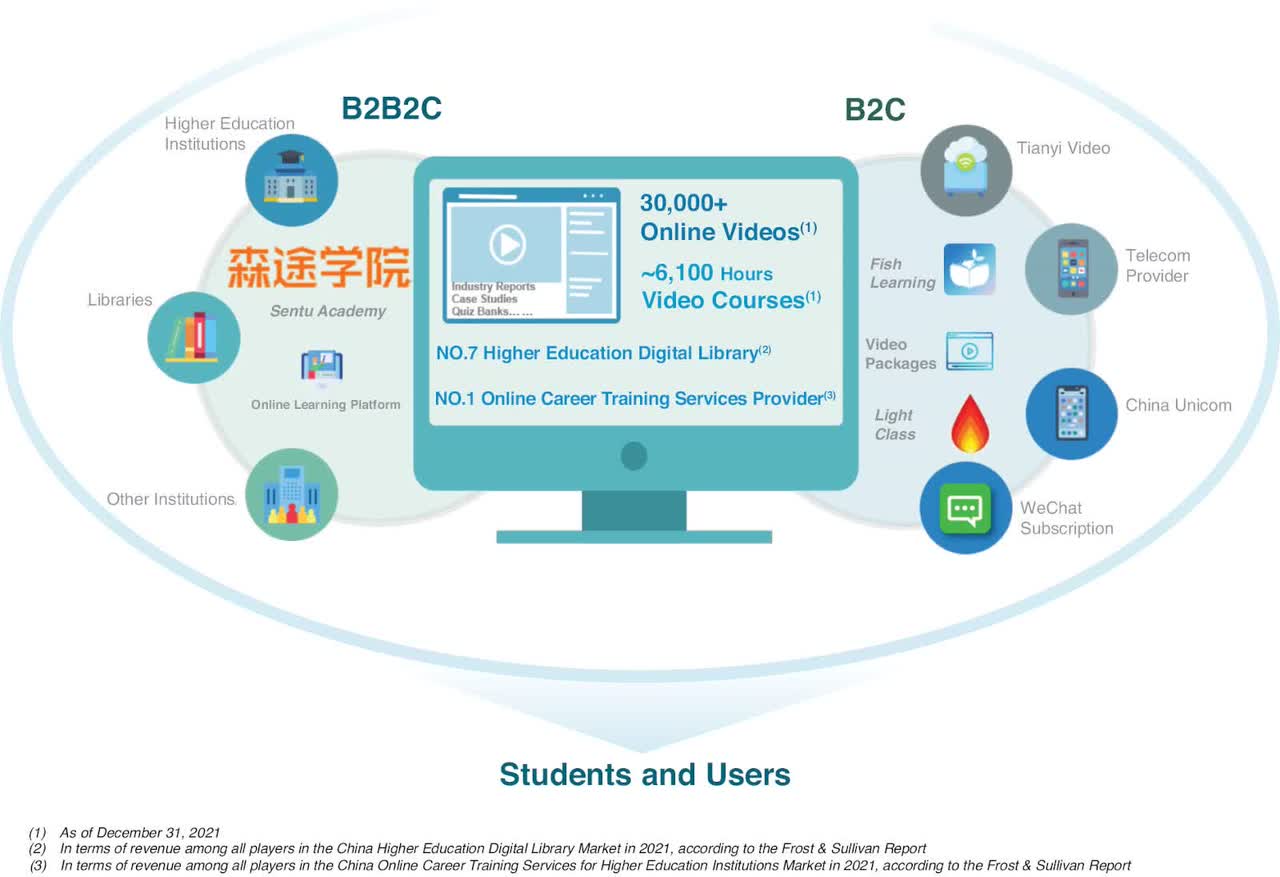

Below is a graphic showing the firm’s two go-to-market approaches, through businesses B2B2C and direct to consumers, or B2C:

Jianzhi Market Approach (SEC)

Jianzhi Education has booked fair market value investment of $26.8 million in equity and debt as of December 31, 2021 from investors including RongDe Holdings, ZhongSiZhiDa, RoseFinch Aquarius and Dongxing Securities (Hong Kong).

Jianzhi Education – Customer Acquisition

The firm seeks customers among businesses that use its content in their online course offerings.

JZ also markets its education content directly to consumers seeking higher education and professional level training.

The firm says it is the 7th largest digital content provider for higher education materials in China.

Sales and Marketing expenses as a percentage of total revenue have risen as revenues have increased, as the figures below indicate:

|

Sales & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

1.6% |

|

2020 |

1.2% |

(Source – SEC)

Jianzhi’s Sales and Marketing efficiency multiple was 9.0x in the most recent year.

Jianzhi Education’s Market & Competition

According to a 2019 market research report by ResearchAndMarkets, the overall Chinese education services market is forecast to reach a total value of nearly $573 billion by 2023.

This represents a forecast CAGR of 11.3% from 2018 to 2023.

The main drivers for this expected growth are rising household wealth, growing government spending on education and an increase in urban population requiring further skill development.

Also, there is a growing demand for online courses especially as a result of the pandemic and a dual-teacher model in lower-tier cities which can result in higher course completion rates and student success.

The firm faces what it calls “fierce competition” from other companies that compete on a variety of factors:

-

Brand awareness

-

Scope of online course offerings

-

Product pricing

-

Modern, interactive content

-

Technology support

-

Ease of use of courses

-

Expertise in sales and market

-

Performance track record

Jianzhi Education Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue

-

Reduced gross profit and gross margin

-

Lower operating profit

-

Increased cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 74,262,826 |

16.8% |

|

2020 |

$ 63,574,317 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 16,350,493 |

-19.4% |

|

2020 |

$ 20,275,269 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

22.02% |

|

|

2020 |

31.89% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ 7,969,550 |

10.7% |

|

2020 |

$ 12,948,028 |

20.4% |

|

Comprehensive Income (Loss) |

||

|

Period |

Comprehensive Income (Loss) |

Net Margin |

|

2021 |

$ 7,605,964 |

10.2% |

|

2020 |

$ 12,919,296 |

17.4% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ 23,188,898 |

|

|

2020 |

$ 15,347,297 |

|

(Source – SEC)

As of December 31, 2021, Jianzhi Education had $9.6 million in cash and $69.2 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was $23.2 million.

Jianzhi Education Technology Group Company IPO Details

Jianzhi Education intends to raise $30 million in gross proceeds from an IPO of its American Depositary Shares representing underlying ordinary shares, offering 5 million ADSs at a proposed midpoint price of $6.00 per ADS.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO, the company’s enterprise value at IPO would approximate $337 million, excluding the effects of underwriter over-allotment options.

The float to outstanding shares ratio (excluding underwriter over-allotments) will be approximately 8.26%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

Management says it will use the net proceeds from the IPO as follows:

Approximately 50.0% expected to be used for developing and producing new educational content and purchase educational content from third parties. In particular, approximately 35.0% will be used to develop and produce new educational content in-house or through commissioning third party enterprises and institutions and approximately 15.0% will be used to purchase educational content from third party enterprises and institutions.

Approximately 25.0% is expected to be used for research and development expenditures in product developing and technology capabilities;

Approximately 10.0% is expected to be used primarily for sales and marketing and customer service activities;

Approximately 10.0% is expected to be used primarily for working capital, such as potential acquisitions and strategic investments, although we have not identified any specific acquisition or investment target; and

Approximately 5.0% is expected to be used primarily for other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management does not believe any legal claims would have a material adverse effect on its financial condition or operations.

The listed bookrunners of the IPO are AMTD and Univest Securities.

Valuation Metrics For Jianzhi Education

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$363,330,000 |

|

Enterprise Value |

$337,430,000 |

|

Price / Sales |

4.89 |

|

EV / Revenue |

4.54 |

|

EV / EBITDA |

42.34 |

|

Earnings Per Share |

$0.12 |

|

Operating Margin |

10.73% |

|

Net Margin |

10.24% |

|

Float To Outstanding Shares Ratio |

8.26% |

|

Proposed IPO Midpoint Price per Share |

$6.00 |

|

Net Free Cash Flow |

$23,176,928 |

|

Free Cash Flow Yield Per Share |

6.38% |

|

Debt / EBITDA Multiple |

0.00 |

|

CapEx Ratio |

1,937.25 |

|

Revenue Growth Rate |

16.81% |

(Source – SEC)

Commentary About Jianzhi Education’s IPO

JZ is seeking U.S. public market investment to fund its internal growth initiatives.

The firm’s financials generated increasing topline revenue, lowered gross profit and gross margin, reduced operating profit but higher cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021, was $23.2 million.

Sales and Marketing expenses as a percentage of total revenue have risen slightly as revenue has increased; its Sales and Marketing efficiency multiple was 9.0x in the most recent year.

The firm currently plans to pay no dividends and in the near term plans to reinvest any future earnings back into the company’s growth initiatives.

The company’s CapEx Ratio is quite high, which indicates it is spending very little on capital expenditures as a percentage of its operating cash flow.

The market opportunity for providing online education to Chinese students is quite large and expected to grow at an elevated rate of growth in the coming years, especially as major events such as the COVID-19 pandemic push consumers toward online learning.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

AMTD is the lead underwriter and there is no data on the firm’s IPO involvement over the last 12-month period.

The primary risk to the company’s outlook is the ongoing uncertainty of government regulatory activity which has whipsawed the industry in recent years.

As for valuation, compared to other online education companies from China, management is asking investors to pay far higher multiples for the stock at the IPO price.

Given ongoing regulatory uncertainties and the high price of the IPO, I’m on Hold for the JZ IPO.

Expected IPO Pricing Date: To be announced.

[ad_2]

Source link