[ad_1]

Examine out what is actually clicking on FoxBusiness.com.

Lordstown Motors Corp.’s capacity to continue to be in business for at minimum another yr continues to be in question right until it secures additional funding and its market worth rises, its finance chief claimed soon after the electric-truck maker bought its manufacturing facility to raise cash.

| Ticker | Security | Past | Change | Change % |

|---|---|---|---|---|

| Journey | LORDSTOWN MOTORS | 2.27 | -.18 | -7.35% |

Lordstown, which aims to start its initial motor vehicle this year and does not crank out any revenue but, issued a likely-issue warning in June 2021, flagging concerns about its monetary health.

“It will be there till we elevate enough cash and get to a higher sector capitalization,” Chief Financial Officer Adam Kroll said Monday, referring to the heading-worry warning. A business is regarded as a heading issue until management intends to liquidate it or stop functions.

LORDSTOWN MOTORS FINALIZES Factory SALE TO FOXCONN

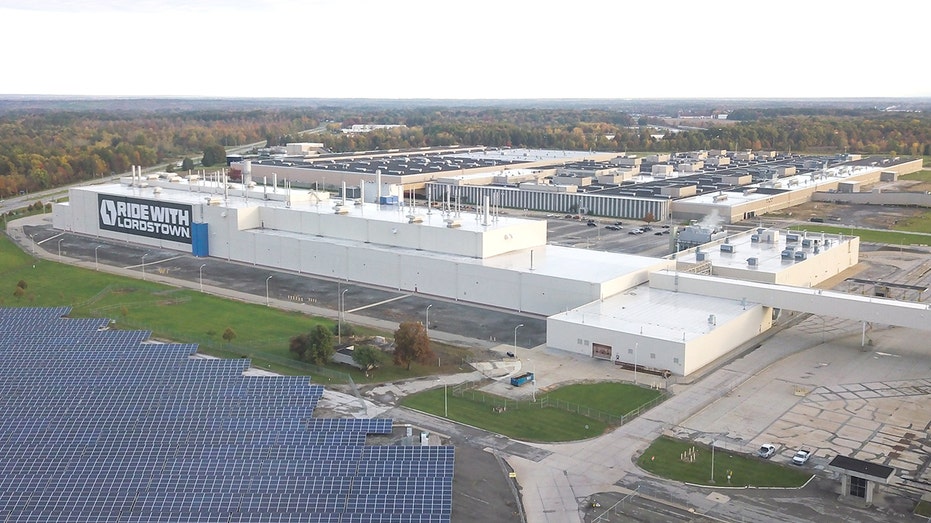

The firm previous week reported it shut a transaction to provide its manufacturing unit in Lordstown, Ohio, to affiliates of agreement assembler Foxconn Know-how Group. Lordstown obtained $230 million for the manufacturing facility, previously a Typical Motors Co. producing web-site, and was reimbursed about $27 million in working and enlargement expenditures by Taipei-dependent Foxconn, which experienced earlier purchased about $50 million in Lordstown shares.

Lordstown, which went public in 2020 as a result of a merger with a specific-purpose acquisition corporation, is in the method of crash tests the Endurance, its first car or truck, and intends to start professional generation in the third quarter.

Lordstown Motors Corp.’s ability to remain in small business for at least yet another year stays in doubt until it secures extra funding and its industry benefit rises, its finance main claimed following the electrical-truck maker marketed its manufacturing facility to increase dollars. (Picture by MEGAN JELINGER/AFP by way of Getty Images / Getty Photographs)

Foxconn, formally acknowledged as Hon Hai Precision Market Co., will build the Stamina for Lordstown and has fully commited $100 million to a new joint undertaking among the two companies. The determination features a $45 million financial loan to Lordstown.

“We are not a 1-trick pony any more,” Kroll explained, pointing to designs to acquire extra automobiles with Foxconn.

Lordstown requirements to raise an added $150 million in cash just before the conclusion of the 12 months to execute on its plans for 2022, which include building about 500 automobiles, Kroll reported. The company aims to have at least $75 million to $100 million in dollars on its harmony sheet at the conclude of this calendar year, he claimed.

The organization held funds and dollars equivalents of $203.6 million at the close of the first quarter, down from $587 million a yr earlier. Lordstown booked a reduction of $89.6 million for the quarter, when compared with a $125.2 million decline in the exact same period a yr before.

Lordstown could elevate cash through a community or personal featuring to institutional investors, Kroll mentioned, incorporating that could involve advertising financial debt or fairness. “There may well be other matters that could require much more strategic associates,” he mentioned.

CARVANA Inventory TUMBLES ON STIFEL DOWNGRADE

Administration is working complete throttle toward the business launch of the Endurance, Kroll explained, introducing that would be an important milestone for the enterprise. “A large section of raising funds is acquiring to launch,” he stated.

Lordstown could experience challenges raising the money it demands amid the new sector selloff, which has hit technology and other stocks difficult. The company’s shares closed at $2.27 Monday, down by 7.4% for the working day and by 39% considering the fact that the starting of the year. Its market place capitalization stood at $448.1 million.

“We are surely in a risk-off setting for EV-startups,” Kroll explained. “I are not able to challenge if or when that may well improve.”

Analysts remain skeptical about the company’s outlook, pointing to difficulties such as fundraising and switching trader sentiment. “In the end, we see the route forward for [the company] as increasingly difficult,” Emmanuel Rosner, an analyst at Deutsche Bank, wrote in a note to shoppers previous 7 days.

GET FOX Enterprise ON THE GO BY CLICKING Here

Lordstown last calendar year disclosed investigations by the Securities and Trade Fee and the Justice Section related to its SPAC transaction and its representations of preorders for the Endurance.

The corporation earlier this thirty day period explained it did not have plenty of cash to execute its small business plan for the yr. It mentioned the condition lifted considerable considerations about its capacity to continue as a likely issue.

Simply click Listed here TO Read through More ON FOX Business enterprise

“As we seek out added sources of funding, there can be no assurance that these kinds of financing would be accessible to use on favorable conditions or at all,” Lordstown stated in its quarterly report. The company also cited increased products expenses and uncertainty all over regulatory acceptance as danger aspects, amid other issues.

[ad_2]

Supply url